Products

Multi-level performance attribution with Prisma Analysis

In asset management, success is not defined solely by returns – it also depends on the transparent attribution of performance. Which allocation decisions proved effective? Which regions or segments drove results? And where did stock selection make the decisive difference? With Prisma Analysis, these questions can be answered with precision – through a consistent performance attribution framework embedded in a modern, user-friendly web architecture.

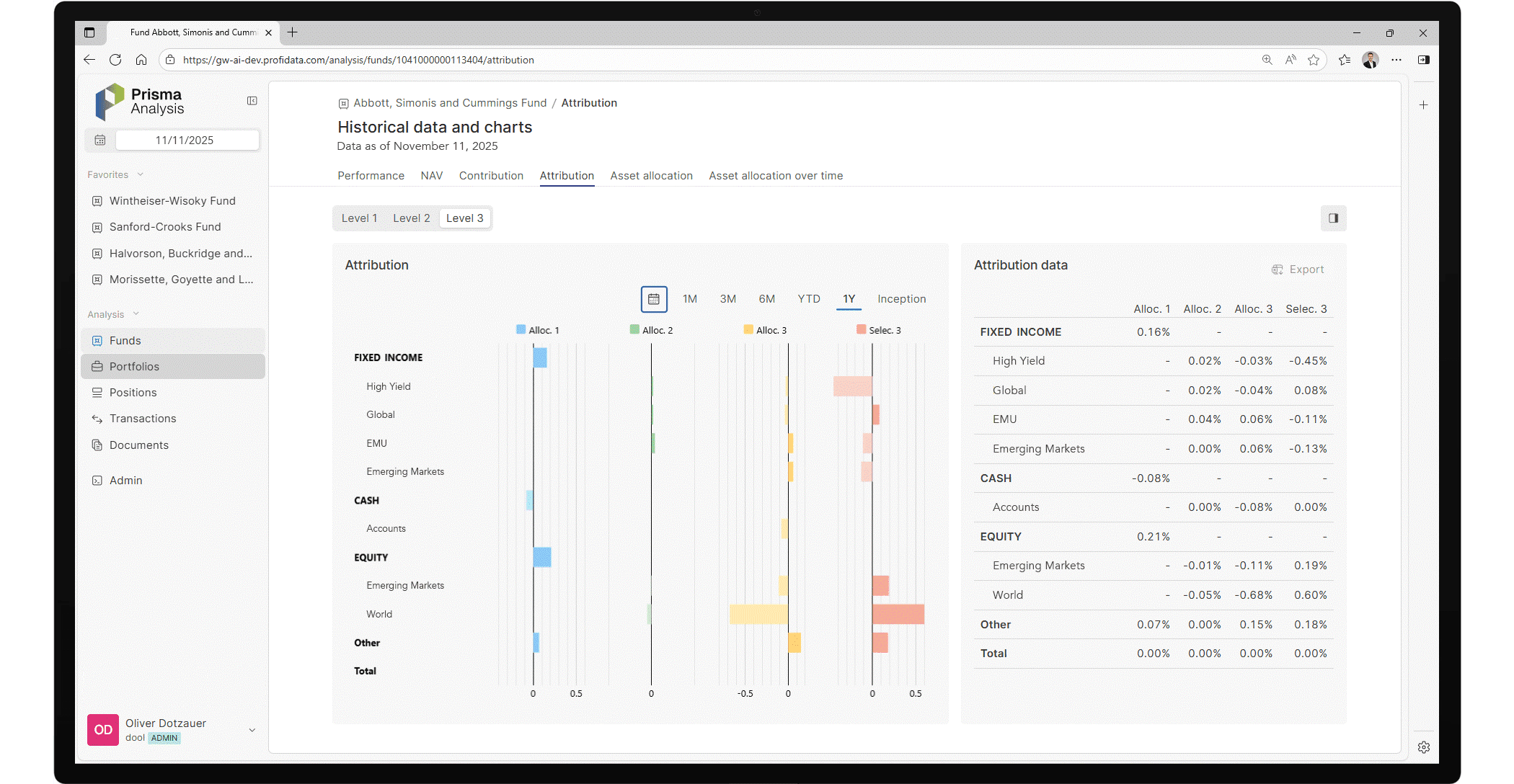

The strength of Prisma Analysis lies in its clear decomposition of portfolio performance along the decision chain of portfolio management. While many systems stop at asset allocation and stock selection, Prisma goes a step further by distinguishing three levels: the main asset class, the sub-class – such as regions or sectors – and the individual investment. This enables our clients to trace exactly how each decision impacts overall performance, making it possible to pinpoint the true drivers of outperformance against the benchmark.

This three-tier granularity delivers analytical depth and a distinct strategic advantage: the entire investment process can be documented and evaluated – from strategic allocation down to the tactical selection of individual securities.

One of the key methodological questions in performance attribution concerns the calculation approach – whether it should be geometric or arithmetic. While the geometric method precisely reflects compounding effects, it often lacks interpretability in practice. Prisma Analysis applies the arithmetic approach, supported by a smoothing algorithm that delivers coherent and intuitively comprehensible results. This ensures that attribution effects can be consistently aggregated – both over time and across different decision levels.

Analytical strength only unfolds its full potential when results can be clearly communicated. For this reason, Prisma Analysis combines precise calculations with a modern, interactive interface. Users gain a comprehensive overview of assets under management, historical developments and transactions, complemented by benchmark comparisons, contribution analyses and risk-adjusted performance metrics.

Results are presented not in static tables, but through interactive screens that enable flexible evaluation. Users can explore data across multiple dimensions, perform detailed drilldowns and export results directly. Exports are available in all common formats, allowing insights to be seamlessly integrated into presentations or regulatory reports.

"Those who aim not only to map their investment processes but to truly understand and continuously refine them will find the ideal solution in Prisma Analysis."

Prisma Analysis is part of an independent web architecture that integrates seamlessly into existing environments. Its open data integration allows access to heterogeneous sources and formats, ensuring that even complex portfolio structures are accurately represented.

Good to know: the solution follows its own release cycle and is continuously enhanced. This means our clients benefit not only from up-to-date methodologies but also from technological flexibility that keeps pace with evolving requirements.

More value in everyday use

For portfolio management, Prisma Analysis means above all one thing: clarity. Decisions are not only documented but also quantified in their impact. Strategic allocations can be precisely evaluated, regional or sector overweights become measurable, and stock selection reveals its contribution in direct comparison with the benchmark.

“Those who aim not only to map their investment processes but to understand and continuously refine them will find the ideal solution in Prisma Analysis,” says Stefan Zimmermann, Senior Business Analyst at Profidata. “Our goal was to take performance attribution out of the black box. With Prisma Analysis, it becomes transparent, practical and an integral part of professional investment management,” he adds.

In an industry where regulatory requirements are increasing and the demand for transparency continues to grow, performance attribution is becoming a key differentiator. With Prisma Analysis, we ensure that you can turn this advantage to your benefit. Our experts are here to support you in strengthening your investment processes for the long term.

Would you like to learn more about Prisma?

Talk to our expert Stefan Zimmermann now and find out how Prisma Analysis can take your analysis processes to a new level.

Book a consultation