Products

XENTIS & Prisma – Redefining investment excellence

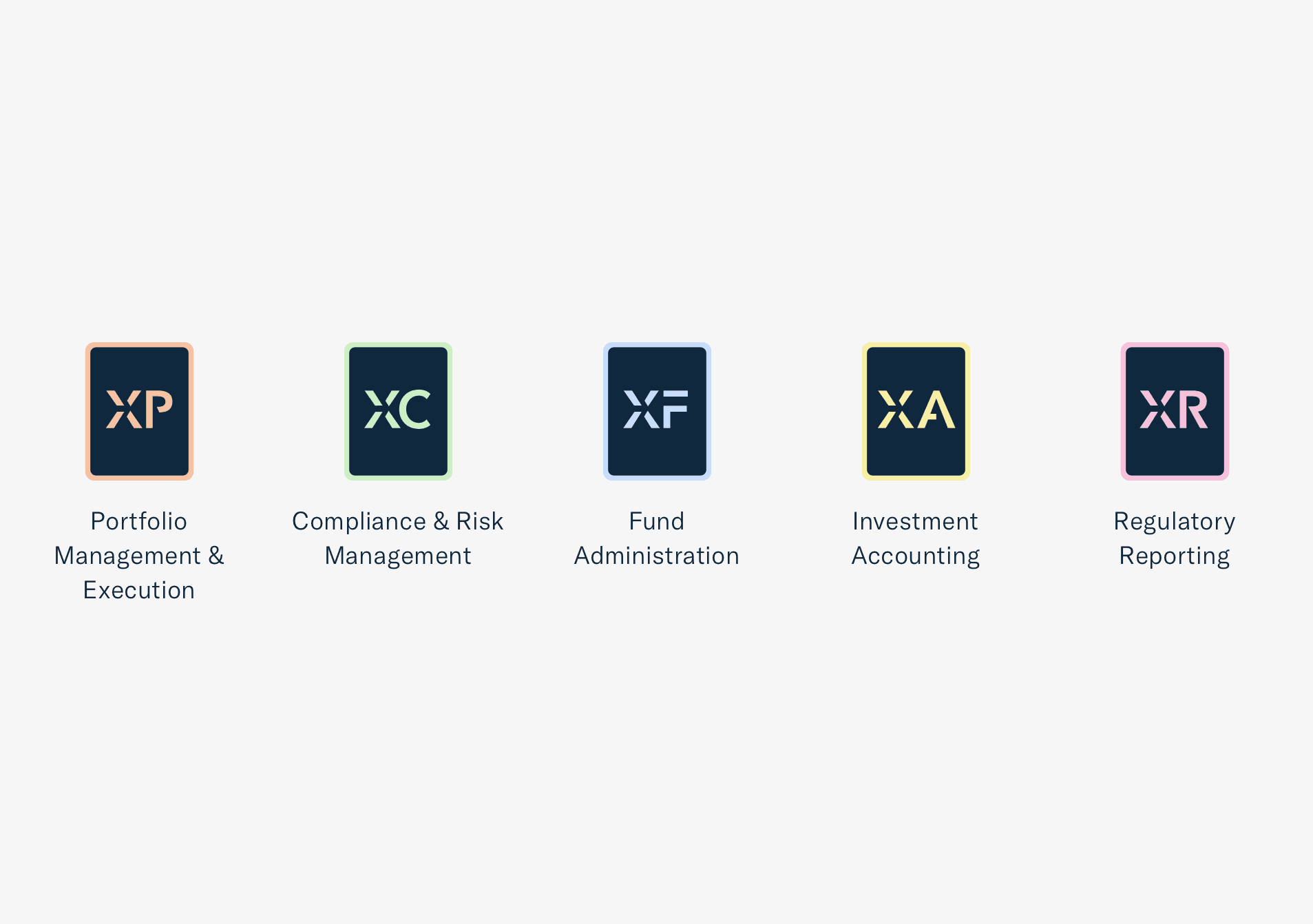

With XENTIS now structured into five areas of expertise, the platform delivers enhanced clarity and strategic focus – complemented by Prisma, a new generation of modular web applications.

The financial industry is facing mounting pressures: regulatory demands are intensifying, asset classes are growing increasingly diverse, and time-to-market has become a decisive success factor. In this environment, what’s needed is a portfolio management solution that is both scalable and operationally agile. That is precisely why we have restructured XENTIS – to provide clearer orientation and a sharper strategic profile.

Each of the five specialised areas reflects a key discipline in investment management: Portfolio Management & Execution, Compliance & Risk Management, Fund Administration, Investment Accounting, and Regulatory Reporting. These can be combined freely, offering clients a high degree of flexibility. With a transparent structure, deep functionality and open architecture, our customers benefit from greater efficiency and adaptability – whether deployed in the private cloud or on-premise.

Built to accommodate all asset classes, XENTIS can be seamlessly integrated into existing system landscapes – either individually or in combination with tailored modules. The result: our clients benefit from bespoke functionality within clearly defined components, enabling fast project rollouts and more agile operations.

The new structure of XENTIS was officially unveiled in June at the 18th Profidata User Conference in Frankfurt. More than 150 participants were in attendance – among them clients, partners and industry experts from across the financial and IT sectors – to exchange insights and explore the latest developments.

“With this refined structure, we are positioning XENTIS for the future,” said Roger Wildi, CEO of Profidata. “Our clients are looking for solutions that align with their specific requirements and organisational models. We are responding to the industry’s growing complexity with structural clarity – enabling greater efficiency, stronger compliance and flexibility.”

Another key milestone at the conference was the launch of Prisma – Profidata’s new line of modular web applications. Designed to serve both specialised teams and end users alike (B2B2C), Prisma offers targeted solutions for clearly defined areas such as order management and asset analysis – intuitive, high-performing and cloud-native by design.

“Our clients are looking for solutions that align with their specific requirements and organisational models.”

With Prisma Analysis and Prisma Order, two specialised modules are already in productive use, while Prisma PM is currently in development as a comprehensive portfolio management solution. All modules are designed for seamless integration into XENTIS and stand out for their rapid deployment, intuitive user experience and independent release cycles.

Roger Wildi views the restructuring as a pivotal step towards ensuring long-term growth and reinforcing Profidata’s position as a technology leader. In his view, robust portfolio management software has become the cornerstone of sustainable success in today’s investment landscape.

Dr. Frank Jenner, Head of Business Development & Marketing at Profidata, adds:

“Our clients successfully use XENTIS/XaaS for both liquid and illiquid assets – either to address specific needs such as portfolio management or investment compliance, or to automate the entire investment process by combining different solutions. The result is significant cost and time savings, along with maximum performance and flexibility in the use of XENTIS/XaaS.”

In addition to updates on XENTIS and Prisma, the Profidata User Conference offered a wide-ranging agenda that explored both strategic themes and hands-on solutions to operational challenges. Daniel Hümbeli, Zoran Sucic and Stefan Siegrist opened the event with valuable insights into Profidata’s latest developments – including the frequent delivery model with monthly releases and significant expansions in the field of alternative investments. The technological roadmap reflects a clear trajectory: XENTIS is evolving consistently as a scalable, integrative and future-ready portfolio management platform.

A detailed introduction to Prisma followed, presented by Stefan Zimmermann and Oliver Dotzauer. The spotlight was on Prisma Order and Prisma Analysis, designed for dynamic portfolio analytics, along with an outlook on Prisma PM as a comprehensive portfolio management solution.

Another highlight was the presentation of the PDM Portal by Richard Kauppert and Dr Joachim Wack – a central tool for meeting DORA compliance requirements in outsourcing oversight. Attendees gained practical insights into its monitoring capabilities, security architecture and upcoming features, including the new XENTIS dashboard for visualising processing workflows. In the area of Professional Services, Martin Frolik, Jessica Hubschmid, Oliver Stör and René Thalparpan shared updates on current client projects and implementation strategies.

Dive deeper: The new specialist areas of XENTIS

Our customers have access to a portfolio management software that adapts precisely to their individual requirements. The platform is now structured into five dedicated areas of expertise:

XENTIS Portfolio Management & Execution automates rebalancing, trade capturing, matching and execution. The software enables precise control of asset allocation, performance attribution and liquidity – with direct connectivity to trading venues. As a leading portfolio management software, XENTIS covers the entire investment lifecycle.

XENTIS Compliance & Risk Management offers rule-based pre- and post-trade checks and look-through analyses. ESG risks and model-based valuations can be fully automated. Simulations and integrated breach management ensure the highest level of regulatory assurance.

From NAV calculation and fee and tax processes to investor management: XENTIS Fund Administration automates fund administration across all asset classes, supported by audit-proof workflows and dynamic structure mapping.

XENTIS Investment Accounting ensures complex accounting processes in accordance with GAAP, IFRS and local standards. Our software enables multi-currency general ledger and subledger accounting, automated tax calculations and integrated valuation procedures.

XENTIS Regulatory Reporting enables full automation of regulatory reporting – including AIFMD, EMIR, Solvency II, CRR/CRD, PRIIP and more. Direct data integration and on-demand reporting tools ensure fast, secure and fully compliant delivery.

A strong foundation: XENTIS Data Platform

At the heart of any optimised investment process lies the availability of consistent, complete and audit-secure data. This is precisely where the XENTIS Data Platform comes into play: as a robust and scalable data architecture, it lays the foundation for informed decision-making and precise analysis.

Our solution oversees all aspects of centralised data management – from integrating and validating external market data to the consolidated administration of internal positions and the automated generation of regulatory reports. Whether equities, bonds, derivatives or structured products, every relevant financial instrument is systematically processed, classified and represented across the platform – ensuring full transparency across both liquid and illiquid holdings. Alternative investments, including private equity, real assets and private debt, are also captured in a structured and standardised manner.

With this architecture, XENTIS bridges the gap between strategic ambition and technological execution – setting a new benchmark for modern portfolio management software.

Prisma in detail: Profidata’s new generation of web modules

Prisma Analysis offers in-depth insights into portfolios and fund structures. Interactive dashboards, granular performance metrics and flexible evaluation tools support data-driven investment decisions. Users benefit from a full overview of assets under management (AuM), historical developments and transaction histories – including benchmark comparisons, contribution analysis and risk-adjusted performance indicators. The intuitive interface and integrated export features ensure smooth downstream processing and clear communication of analytical results.

Prisma Order delivers a seamless, transparent order management process – from initial order entry to audit-proof documentation. Real-time status updates, integrated investment limit checks and a flexible modification engine ensure maximum control and regulatory compliance. The solution supports collective orders and standardised uploads such as BVI sheets. With direct integration into XENTIS and external trading systems, all workflows can be mapped efficiently and in full compliance with regulatory requirements.

The next major milestone is Prisma PM – a comprehensive portfolio management solution currently under development. Designed for professionals managing complex portfolios, Prisma PM focuses on speed, usability and flexible integration. Like all Prisma modules, it is continuously enhanced through an independent release cycle and can be fully customised via white labelling to match individual brand environments.

All Prisma modules meet the highest standards of security and compliance, are ISAE-certified and deliver rapid scalability through their SaaS-native architecture. They are browser-based, single sign-on compatible, and designed to integrate easily with third-party systems and external data sources – providing maximum flexibility across a wide range of use cases. With Prisma, Profidata is setting new benchmarks for modular, streamlined investment technology.

Whether you are an asset manager, custodian or fund management company – arrange a non-binding consultation with our experts and discover how XENTIS and Prisma can help future-proof your investment operations.

Contact usBEYOND THE CORE

Discover our expertise

How can we help you?

Get in touch with us directly! Our experts look forward to hearing from you.

Book a consultation